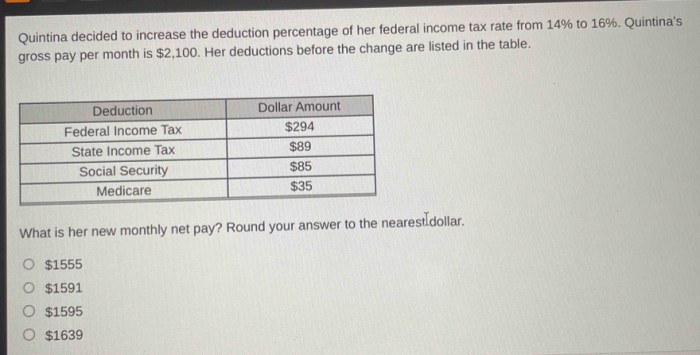

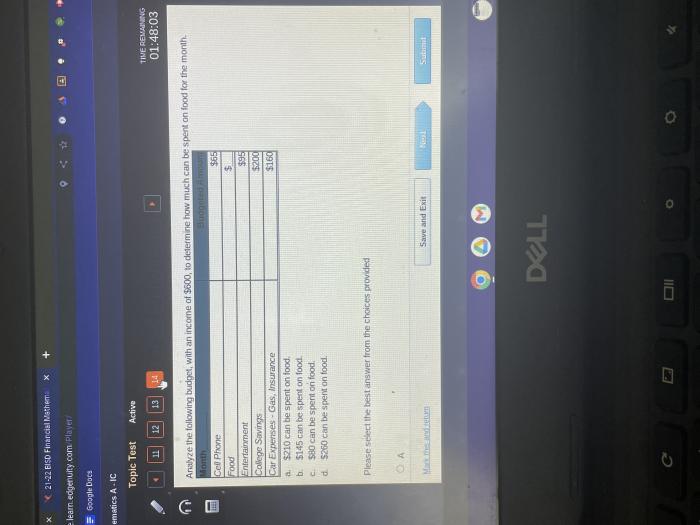

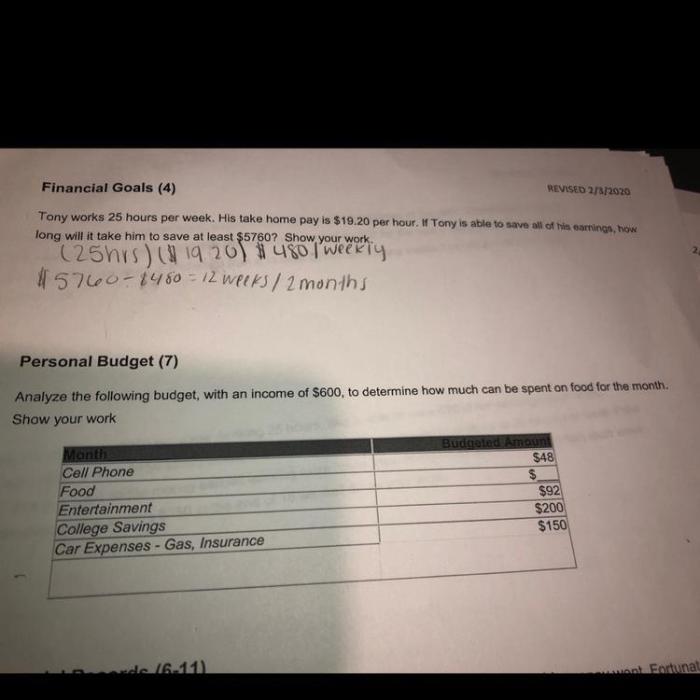

Analyze the following budget with an income of $600 presents a comprehensive guide to understanding and optimizing personal finances within a constrained income. This detailed analysis delves into income sources, expenses, cash flow, and financial goal alignment, empowering individuals to make informed decisions and achieve their financial aspirations.

Through a structured approach and practical recommendations, this guide provides a roadmap for maximizing financial resources, minimizing expenses, and building a secure financial foundation. Whether you seek to reduce debt, save for the future, or simply live within your means, this analysis offers invaluable insights and actionable steps to transform your financial well-being.

Budget Analysis

The following is a comprehensive analysis of a budget with an income of $600, providing insights into income sources, expenses, cash flow, optimization opportunities, financial goal alignment, and contingency planning.

Income and Expense Summary

Income Sources:

- Salary: $400

- Part-time work: $100

- Investment income: $50

- Other: $50

Expenses:

- Rent/mortgage: $150

- Utilities: $50

- Groceries: $100

- Transportation: $50

- Entertainment: $25

- Savings: $25

- Other: $50

Cash Flow Analysis

Operating Activities:

- Income: $600

- Expenses: $550

- Net cash flow from operating activities: $50

Investing Activities:

- None

Financing Activities:

- None

Overall Cash Flow:$50

Budget Optimization: Analyze The Following Budget With An Income Of 0

Expense Reduction:

- Negotiate a lower rent/mortgage rate

- Shop around for cheaper utilities

- Reduce entertainment expenses

- Consider carpooling or public transportation

Income Generation:

- Take on additional part-time work

- Start a side hustle

- Invest in income-generating assets

Financial Goal Alignment

The budget is sufficient to cover essential expenses and leave a small amount for savings. However, it may not be sufficient to achieve long-term financial goals, such as retirement or purchasing a home.

Contingency Planning

Potential Risks:

- Loss of income

- Unexpected expenses

- Economic downturn

Contingency Plan:

- Maintain an emergency fund

- Consider income protection insurance

- Explore debt consolidation options if necessary

Top FAQs

What are the key components of a budget analysis?

A budget analysis typically includes a detailed breakdown of income sources and expenses, a cash flow statement, identification of areas for optimization, and alignment with financial goals.

How can I reduce expenses on a limited income?

Consider negotiating bills, exploring cost-effective alternatives, reducing discretionary spending, and implementing energy-saving measures to minimize expenses.

What is the importance of aligning my budget with financial goals?

Aligning your budget with financial goals ensures that your spending supports your long-term aspirations, such as saving for retirement, purchasing a home, or pursuing higher education.